|

This Commentary:

- Unpacks the hidden costs of dismissing emerging trends as “irrelevant”

- Explores why short-term thinking persists in traditional MedTech leadership

- Challenges the industry’s reliance on outdated playbooks and familiar metrics

- Highlights strategic blind spots - from AI and value-based care to patient-centricity and global markets

- Offers a lens on what it takes to stay relevant in a shifting healthcare landscape

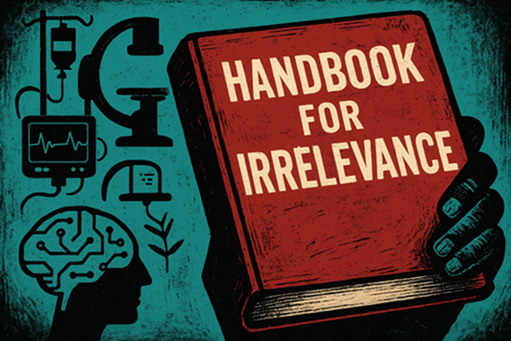

MedTech’s Blueprint for Failure

Let us begin with respect. The seasoned MedTech executive is not a figure of the past, but the architect of the present - responsible for building some of the most durable, trusted, and clinically impactful companies in healthcare. These leaders have guided global organisations through shifting regulations, economic cycles, and evolving standards of care. They have delivered not just products, but platforms of safety, precision, and reliability that clinicians and patients around the world depend on. Their legacy is real, earned, and deeply embedded in the modern healthcare system.

MedTech leaders have operated in environments defined by complexity - balancing regulatory scrutiny with engineering excellence, margin pressure with operational discipline, and clinical outcomes with commercial scale. They have not just adapted to change; they have often outlasted it. And while others have chased the latest buzzword or market trend, these executives have anchored their strategies in consistency, trust, and results.

Yet in many boardrooms today - especially those contending with near-term headwinds - pressing concerns like debt, tariffs, remediation, stagnant growth, and quarterly targets increasingly overshadow the pursuit of long-term strategy. Anything not tied directly to fixing, shipping, or selling is often sidelined. Innovation becomes a luxury. Structural change is postponed. And conversations about AI, value-based healthcare, emerging markets, or digital-transformation are acknowledged but often not given the time they merit.

This mindset is not irrational - it is forged under pressure and reinforced by financial reality. But the cost of sidelining strategic evolution is often subtle and slow building, only revealing its consequences over time. Early symptoms - like subtle shifts in talent retention, slight erosion of market positioning, or narrowing strategic options - are easy to dismiss under the pressure of day-to-day demands. Yet, by the time the damage becomes visible on a balance sheet, the organisation is often already in decline, with fewer, harder, and more expensive paths to recovery.

It is within this diagnostic blind spot - where early warnings go unnoticed or unheeded - that we locate the central tension facing today’s legacy institutions: the trade-off between operational resilience and strategic relevance. It is in the spirit of this tension that we offer the following reflection. Not a barrage of new imperatives, but an inventory of what over decades has too often been dismissed as “irrelevant” or “peripheral” by established leadership. Not to mock, but to reflect. Not a rejection of their discipline, but a gentle inquiry: what truths might be slipping through the cracks beneath the weight of short-term certainty?

In this Commentary

This Commentary explores the growing disconnect between the operational priorities of legacy MedTech companies and the strategic shifts reshaping the industry. It highlights the mindsets, market signals, and structural forces often dismissed as ‘irrelevant’ or ‘peripheral’ - AI, digital therapeutics, emerging markets, patient agency - and contends that what has long been sidelined may, in fact, shape the essence of today's competitiveness - and define that of tomorrow. It is both a reflection on the past and a challenge to reimagine relevance before the market makes the decision for us. The Commentary is essential reading for MedTech executives because it surfaces the uncomfortable truths behind strategic stagnation, offering a candid lens on how legacy thinking - while once effective - may now be undermining future viability.

AI & Machine Learning: “Hype for Those Without Real Products”

AI and machine learning have become the preferred language of tech evangelists, analysts, and keynote speakers - often cited with urgency, as if predictive algorithms alone can remake healthcare. But for many in traditional MedTech, these developments remain abstract. After all, who needs real-time clinical insight when a mature salesforce, a trusted product line, and a robust procurement process continue to deliver quarter after quarter? Why invest in data infrastructure when the commercial team already “knows the customer”?

AI, legacy executives argue, may be making waves in radiology, accelerating image analysis, reducing diagnostic errors, and even optimising surgical workflows - but where is the SKU? Where is the billing code? And until machine learning finds its way into a procurement algorithm or a reimbursement pathway, it can be safely filed under “interesting, but not actionable.”

What is often overlooked is that while AI might not yet sit neatly on the income statement, it is rapidly embedding itself in the competitive context - influencing everything from operational efficiency to clinical decision-making.

But for now, the advantage of declaring it irrelevant is that it requires no investment, no transformation, and no urgency. It remains a future problem - and for many executives, that is precisely the point.

Value-Based Care: “A Fine Theory for Panels and Podcasts”

Value-based care has become something of a permanent fixture at healthcare conferences - a well-rehearsed talking point, often nestled between ESG updates and digital transformation slides. It is the kind of topic that earns nods on stage and silence in the boardroom. Yes, payers talk about outcomes, total cost of care, and shifting financial risk upstream. But for many traditional MedTech executives, these are macro-level abstractions - ambient noise in a world still largely driven by volume, device utilisation, and unit sales.

The logic is simple: procedures are still reimbursed, hospitals still procure on precedent, and the salesforce still delivers - why rethink the fundamentals? Why disrupt a business model built on predictability just because someone rebranded cost containment as “value”?

Beneath the surface, the shift toward value-based care is gathering momentum. Contracts are increasingly tied to performance metrics, and payers are testing shared savings models. Providers are beginning to reassess the true, end-to-end cost of patient care. Yet fully embracing these changes means confronting uncomfortable realities - exposure, accountability, disruption. And so, value-based care remains more aspiration than action: cited with reverence but kept at arm’s length.

A compelling vision of tomorrow - just not one that needs to interfere with this quarter’s pricing strategy.

Consumerisation & Patient-Centricity: “Charming, But Not for Us”

The notion of consumer empowerment in healthcare has always held a certain charm - well-suited, perhaps, to wellness apps. Talk of patient autonomy, real-time health tracking, and personalised care journeys tends to generate polite applause, especially at innovation forums and digital health expos. But in the commercial reality of MedTech, where relationships are measured in surgeon loyalty and purchasing decisions rest with procurement committees, this wave of patient-centric rhetoric can feel somewhat . . . ornamental.

After all, patients are not the buyers. They are not typically involved in procurement decisions or responsible for evaluating tenders. The idea that individuals managing chronic conditions might influence device design, data visibility, or treatment planning introduces an unfamiliar variable into a system optimised for clinical workflows and sales cycles.

And yet, slowly, persistently, the paradigm is shifting. Patients are choosing care pathways. They are tracking their own health data. They are becoming participants, not passengers. Platforms that once served physicians now speak directly to the patient.

But for many MedTech incumbents, this shift remains peripheral - acknowledged just enough to be applauded, but not yet enough to require change.

|