|

2. Poor prognostic indicators for spinal surgery

This dearth of evidence makes therapy decisions challenging for clinicians. A study published in the 2018 edition of the Asian Spine Journal suggests that a proportion of the large and increasing spine fusion surgeries performed to reduce LBP and degenerative disc disorders fails because of weak prognostic indicators. Researchers stress that, “spine surgeons need to be well aware of the many poor prognostic indicators for spinal surgery”. The lack of high-quality evidence to support the use of spinal fusion for LPB fosters disagreement among physicians as to when spinal fusion should be performed.

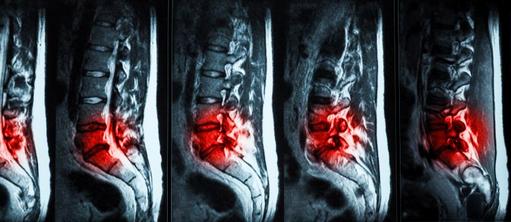

In the video below Nick Thomas, a consultant neurosurgeon at King’s College Hospital, London, describes some of the challenges of poor prognostic indicators for LBP: “Dilemmas of managing low back pain arise because we (clinicians) have precious few pre-operative investigations that give us a clear idea as to whether a spinal fusion may or may not work. When an MRI is taken it can be very difficult to determine whether the degenerative discs one sees on the scan are normal age-related changes or whether they truly reflect a problem that might be generating the back pain”, says Thomas.

Such dilemmas in the management of LBP are not made easier by the fact that there are few studies, which compare spinal fusion to a placebo procedure. Most spine surgery research compares one fusion technique to another or to a form of non-surgical treatment. According to a study published in the March 2020 edition of The Lancet , “Over the past 10 years there has been increasing recognition of the importance of the placebo effect, particularly how strong this effect could be for a surgical procedure that involves high-intensity medical care, strong analgesia, and often physiotherapy”. Findings of recent placebo-controlled surgical trials for common vertebroplasty procedures [a procedure for stabilizing compression fractures in the spine], in which special cement is injected into a fractured vertebra, “have been shown to be largely ineffective, but continue to be in common use”. Further, randomised clinical studies, which are regarded as providing the highest-quality evidence, suggest that spinal fusion has little advantage over a well-structured rehabilitation programme for LBP.

A study published in the December 2018 edition of the Journal of Internal Medicine analysed data from 33 randomized controlled trials and other studies comparing spinal fusion to nonoperative solutions for LBP and degenerative spine conditions, and concluded that, “The overwhelming evidence simply doesn’t support spinal fusion (and its high costs and risks) for back pain and degenerative spine conditions over nonoperative solutions”. A 2019 WHO Bulletin entitled ‘Care for low back pain: can health systems deliver?’ suggests that, “many healthcare systems are not designed to support physical and psychological therapies for LBP”, and stresses that, “major international clinical guidelines now recognize that many people with low back pain require little or no formal treatment”.

3. Uncertainties of diagnosing LBP

Adding to poor prognostic indicators are the difficulties of diagnosing LBP. The aetiology of LBP is rarely precisely identified. Findings also suggest that a pathoanatomical diagnosis of LBP can only be made in ~5% to 7% of patients. LBP in patients where no such diagnosis is possible is often labelled, unscientifically, “chronic LBP”.

A 2016 study suggests that in ~80% to 95% of patients with LBP the cause cannot be determined despite the existence of sophisticated imaging techniques and a plethora of diagnostic tests. It seems reasonable to suggest that challenges associated with diagnosing LBP could provide tacit support for clinicians to continue carrying out surgical procedures they were trained to perform.

4. Rapidly ageing populations

A rapidly increasing global geriatric population is a significant factor driving the growth of the spinal fusion market. According to the United Nations, ~16% of the world’s population will be ≥65 by 2050. In North America and Europe, ~25% of their respective populations will be aged ≥65 by 2050. Common disorders of old age include LBP and degenerative disc disorders.

Age is significant because most spinal fusion procedures are performed on individuals ≥60 living in wealthy nations. This age cohort is the fastest-growing demographic in the principal spine markets of the US, Western Europe, and Japan. For example, the US has ~49m people (~15% of the population) who are aged ≥65. This cohort is projected to reach ~84m by 2050. The EU-27 has ~90m people (~20% of the population) ≥65. By 2050 the EU population ≥65 is expected to reach ~130m. The population structure of the UK is similar to that generally observed in the EU-27 with ~12m people aged ≥65, ~18.5% of the population, which is projected to double by 2050. Japan has the oldest population in the world with ~36m people (~29% of the population) who are ≥65. By 2025, Japan’s ≥65 population is expected to decrease to ~33m, but the percentage of the population ≥65 is projected to increase to ~32%. It seems reasonable to suggest that these vast and rapidly increasing older population cohorts are significant drivers of the growth of age-related LBP and the consequent increasing incidence rates of spine surgeries.

Global life expectancy has continued rising and is expected to reach 77 years by 2050, up from 70 in 2015. The number of people ≥65, who account for most spine surgeries, will climb by >60% in the next 15 years: from ~0.6bn in 2015 to ~1bn by 2030. The phenomena of aging and shrinking populations, means that every year, a shrinking pool of working-age people are forced to support an expanding pool of ageing patients with LBP and degenerative disc disorders. In the medium to long term such support seems unsustainable.

5. Obesity

The prevalence of LBP in individuals ≥65 who are also obese is significantly higher than in people who are of average weight. Not only are the populations in the principal spine markets ageing, but they are also experiencing rising incidence rates of obesity. According to the World Health Organisation, obesity throughout the world has nearly tripled since 1975. Today, there are ~2bn adults overweight, of those, ~650m are obese [body mass index (BMI) ≥30 kg/m²]. In England ~28% of adults are obese and a further 36% are overweight. In the US, 43% of people ≥60 is obese. From 2000 to 2018, the prevalence of obesity in the US increased from 31% to 42%, and the prevalence of extreme obesity [BMI ≥40 kg/m²] increased from 5% to 9%.

6. High costs of spine surgeries

Most spine surgeries in the US have been covered by health insurance operating a fee-for-service model. A future Commentary describes how this model is changing. Notwithstanding, fee-for-service has meant that healthcare providers have been able to charge significant amounts for their services and oblige insurance companies to reimburse them, while inflicting minimal costs on patients. Although there is a paucity of studies which analyse recent trends in spinal fusion volume, utilization, and reimbursements, Medicare [a US national health insurance programme] payment trends have seen a decreasing allocation of reimbursements for surgeons generally. Research published in the October 2020 edition of The Spine Journal suggests that this, “may be the effect of value-based cost reduction measures, especially for high-cost orthopaedic and spine surgeries”.

Each year in the US, >$90bn is spent on low-back pain alone and ~1.6m spinal surgeries are performed. The cost of a single-level spinal fusion in a less expensive region of the US is ~US$65,000 for Medicare or ~US$100,000 with private insurance. In more expensive areas, such as New York or Los Angeles, these costs can grow by 2 to 3 times. In remote regions, such as eastern Wyoming and Alaska, high costs of surgical procedures can be a function of the scarcity of specialist clinicians. Such high costs could be an incentive for physicians to perform surgery. Research supports this by suggesting that clinicians are more likely to recommend surgery, even though it is neither the optimum nor the only treatment option available.

7. Benign reimbursement policies

Historically, in the US, third-party payors have tended to reimburse spine surgery for LBP more than non-invasive therapies. Insurers have also tended to reimburse surgical services rather than patient outcomes, although this is changing. For decades, the overwhelming percentage of patients bore little responsibility for the cost of spine surgeries. However, a 2016 New York Times article reported that reimbursement policies for spine surgery were beginning to change, and suggested that, “financial disincentives accomplished something that scientific evidence alone didn’t”. The Times article drew on findings of research published in the June 2016 edition of the journal Spine, which argued that, “spinal fusion rates continued to soar in the US until 2012, shortly afterwards Blue Cross of North Carolina said it would no longer pay”. It seems reasonable to assume that benign reimbursement policies helped to drive the increase in spine surgeries. However, following the Blue Cross decision other insurers followed, and US payors started to move away from a fee-for-service model towards reimbursing “value”. This shift, which is expected to continue, has slowed the growth rate of common spine surgeries.

Takeaways

Over the past three decades, the escalating prevalence of LBP, the challenges of diagnosing the condition, rapidly ageing populations, rising incidence rates of obesity, high costs of spine surgeries, and benign reimbursement policies, have all contributed to what has become a global spinal implant and devices industry. Such conditions encouraged an ecosystem in which the incidence rates of spine surgeries have soared, while LBP has persisted in a significant percentage of patients following surgery. Although the spine market is beginning to transform itself by moving away from a fee-for-service model towards a value-based model, which aims at providing patients with the best outcomes at the lowest cost, do not underestimate the time it will take for this transformation to succeed. Indeed, it seems reasonable to suggest that, given the structure and nature of the industry, the paradox that this Commentary attempts to explain will persist, at least for the near to medium term.

Post Scriptum

Findings of a 2016 study in the peer reviewed Malaysian Orthopaedic Journal conclude that, “The spine, unfortunately, has been labelled as a profit centre and there are allegations of conflicts of interest in the relationship of doctors with the multi-billion-dollar spinal devices industry. The spine industry has a significant influence not only on research publications in peer review journals, but also on decisions made by doctors, which can have a detrimental effect on the welfare of the patient”.

|