Publications

- All

-

Following

You must log in

before getting

tailored content. -

Interests

You must log in

before getting

tailored content. - Most liked

- Most viewed

Family Cosmetic & Implant Dentistry of Brooklyn is considered one of the best dentist available in the area and honored as the top New York dentist of 2017. We offer all the most popular dental procedures from teeth whitening and cleaning to the treatment of complicated issues that require surgery. With our limited time event, offering 5–10% off any service for new patients, now is the perfect time to get the smile you always wanted.

Family Cosmetic & Implant Dentistry of Brooklyn

2148 Ocean Ave, Ste 401,

Brooklyn, NY 11229

(718) 339–8852

Web Address: https://www.dentistinbrooklyn.com/

Our location on the map: https://goo.gl/maps/ryGk7UuvoUBX4xX77

https://plus.codes/87G8J25V+C8 Brooklyn

Nearby Locations:

Midwood | Marine Park | Madison | Homecrest | Mapleton

11230 | 11234 | 11229 | 11204

Working Hours:

Monday: CLOSED

Tuesday: 10:00 am — 7:00 pm

Wednesday: 10:00 am — 7:00 pm

Thursday: 10:00 am — 7:00 pm

Friday: 10:00 am — 7:00 pm

Saturday: 9:00 am — 5:00 pm

Sunday: CLOSED

Payment: cash, check, credit cards.

Brooklyn dentist Igor Khabensky is a compassionate and dedicated general and cosmetic dentist serving the Brooklyn community. Dr. Khabensky received his dental degree after attending New York University and completed his residency in general dentistry at Woodhull Medical Center. He is highly experienced and competent in all areas of family dentistry such as pediatrics, tooth extractions, implants, and cosmetic dentistry.

Dr. Khabensky of Family Cosmetic & Implant Dentistry is affiliated with Woodhull Medical and Mental Health Center in Brooklyn, NY. Dr. Khabensky is multilingual in English, Spanish, and Russian, and his awareness of these different languages makes him more accessible to patients in Brooklyn from a variety of cultural backgrounds.

Dentist in Brooklyn, Dr. Khabensky’s top priority is to provide his patients with thorough treatment planning and fantastic bedside manner. Our Family Cosmetic & Implant Dentistry of Brooklyn is proud to offer our patients only the most revolutionary technology available in dentistry today: the Waterlase MD™ Dental Laser.

Family Cosmetic & Implant Dentistry of Brooklyn

2148 Ocean Ave, Ste 401,

Brooklyn, NY 11229

(718) 339–8852

Web Address: https://www.dentistinbrooklyn.com/

Our location on the map: https://goo.gl/maps/ryGk7UuvoUBX4xX77

https://plus.codes/87G8J25V+C8 Brooklyn

Nearby Locations:

Midwood | Marine Park | Madison | Homecrest | Mapleton

11230 | 11234 | 11229 | 11204

Working Hours:

Monday: CLOSED

Tuesday: 10:00 am — 7:00 pm

Wednesday: 10:00 am — 7:00 pm

Thursday: 10:00 am — 7:00 pm

Friday: 10:00 am — 7:00 pm

Saturday: 9:00 am — 5:00 pm

Sunday: CLOSED

Payment: cash, check, credit cards.

Find us: https://www.vitadox.com/doctor/homecrest-brooklyn-ny-11229/igor-khabensky-dds/c2M6eTSb8N5B54BixbgQZT

Directory:

Tags:

Treatment for gingivitis in the Bronx, NY isn’t something you should put off. Treatment for gingivitis begins as soon as your periodontist recognizes the early warning signs. That’s why it helps to find a dentist open on Saturday and Sunday to provide you with the treatment you need when you can’t make a regular weekly appointment. Pregnancy gingivitis treatment is specialty care that doesn’t compromise the health of your baby.

Having healthy teeth and gums has beneficial effects on your overall health. Poor oral hygiene can lead to compromised health and lifelong dental problems. The leading cause of tooth loss in the United States is gingivitis, which worsens to periodontitis, or gum disease.

Gingivitis is the earliest stage of gum disease. It affects people of all ages, and most people experience symptoms at least once in their lives. It’s an inflammation of the gum caused by a number of factors. Whatever the root cause, it’s plaque hardening into tartar and collecting bacteria that leads to infection and inflammation of your gums.

Do You Have Gingivitis?

Symptoms can vary from mild to severe, depending on your oral hygiene, medical history and the duration of the disease. Immunocompromised individuals or those taking certain drugs are more likely to develop gingivitis. Hormonal states like pregnancy are also a risk factor because of the hormones and increased blood flow to your gums. Getting pregnancy gingivitis treatment prevents the likelihood of premature birth.

If you experience symptoms like bleeding gums, dark, dusky discoloration of your gums, bad breath or shifting teeth, you may have gingivitis. Even though not all cases of gingivitis proceed to gum disease, your dentist (open on Sunday) gives you the best treatment for gingivitis to prevent its progression.

Read more: https://www.bronx-ny-dentist.com/gingivitis-treatment/

505 Dental Associates

505 Claremont Parkway,

Bronx, NY 10457

(718) 299-3600

Web Address: https://www.bronx-ny-dentist.com

Our location on the map: https://g.page/dentist-in-the-bronx-nyc

https://plus.codes/87G8R3QX+CC Bronx

Nearby Locations:

Parkchester | Van Nest | Morris Park | Pelham Bay | Schuylerville | Allerton

10460 | 10461 | 10462 | 10465 | 10467

Working Hours:

Monday: 9:00 am - 5:00 pm

Tuesday: 9:00 am - 8:00 pm

Wednesday: 9:00 am - 8:00 pm

Thursday: 9:00 am - 8:00 pm

Friday: 9:00 am - 5:00 pm

Saturday: 8:00 am - 3:00 pm

Sunday: CLOSED

Payment: Discover, Visa, Invoice, MasterCard, Check, Cash, Financing, American Express.

Directory:

Tags:

When you consider a dental bridge in the Bronx vs. implant costs, the dental bridge may be a better investment. And how long does a dental bridge last? That’s a primary concern you shouldn’t have to worry about when you visit a top Bronx dentist. Once you build a rapport with the best dental team in the Bronx, you can trust their recommendations. Their only concern is for your oral health and the oral health of your family.

If you’re missing a tooth in one or two areas, but have strong teeth surrounding the gap, you’re in luck, especially if the missing tooth is along the same arch, top or bottom. Getting a dental bridge is one of the dental alternatives for retaining the appearance of a full mouth of teeth. Having a bridge can make chewing easier, and it allows you to retain the shape of your mouth without having to go with full-on dentures.

If your top NYC dentist has discussed getting a bridge with you, you’re probably wondering why you should consider it and what’s involved. There are benefits of a dental bridge vs. implant that may be right for you. If you don’t want to have the appearance of missing teeth, come to your cosmetic dentistry center to discuss how a dental bridge can help you.

Why You May Need a Dental Bridge

If you have gaps in your teeth that need to be replaced, but plenty of strong, healthy teeth surrounding the missing ones, a dental bridge may be the solution you’re looking for. Dental bridges provide replacement teeth by working with two crowns that are anchored on each side of the bridge. These crowns may be natural or implanted.

If you’re weighing the risks and pain between a dental bridge vs. implant, bridges offer a quick solution and may be less costly. A dental bridge is cheaper than having implants and isn’t as time-consuming, either. The visits are typically split into two. On the first visit, the dentist scrapes away some of the enamel to create room for a crown to go over your natural teeth. He makes molds of your mouth, ensuring that when the bridge is ready, it’s a perfect fit. You’re given a temporary bridge to wear while you wait for the second visit.

Read more: https://www.bronx-ny-dentist.com/dental-bridge/

505 Dental Associates

505 Claremont Parkway,

Bronx, NY 10457

(718) 299-3600

Web Address: https://www.bronx-ny-dentist.com/

Our location on the map: https://g.page/dentist-in-the-bronx-nyc

https://plus.codes/87G8R3QX+CC Bronx

Nearby Locations:

Parkchester | Van Nest | Morris Park | Pelham Bay | Schuylerville | Allerton

10460 | 10461 | 10462 | 10465 | 10467

Working Hours:

Monday: 9:00 am - 5:00 pm

Tuesday: 9:00 am - 8:00 pm

Wednesday: 9:00 am - 8:00 pm

Thursday: 9:00 am - 8:00 pm

Friday: 9:00 am - 5:00 pm

Saturday: 8:00 am - 3:00 pm

Sunday: CLOSED

Payment: Discover, Visa, Invoice, MasterCard, Check, Cash, Financing, American Express.

Our best-rated dentists at 505 Dental Associates believe that a healthy mouth is a happy mouth. We are open on Saturday and Sunday and will provide you with the highest quality dental care in our state of the art Bronx dental clinic. Our skilled and experienced dental specialists can handle all your oral health needs. We are currently offering a limited time event, 5–10% discount of any service for new patients. Take advantage of this offer to get the smile you always wanted.

505 Dental Associates

505 Claremont Parkway,

Bronx, NY 10457

(718) 299–3600

Web Address: https://www.bronx-ny-dentist.com/

Our location on the map: https://g.page/dentist-in-the-bronx-nyc

https://plus.codes/87G8R3QX+CC Bronx

Nearby Locations:

Parkchester | Van Nest | Morris Park | Pelham Bay | Schuylerville | Allerton

10460 | 10461 | 10462 | 10465 | 10467

Working Hours:

Monday: 9:00 am — 5:00 pm

Tuesday: 9:00 am — 8:00 pm

Wednesday: 9:00 am — 8:00 pm

Thursday: 9:00 am — 8:00 pm

Friday: 9:00 am — 5:00 pm

Saturday: 8:00 am — 3:00 pm

Sunday: CLOSED

Payment: Discover, Visa, Invoice, MasterCard, Check, Cash, Financing, American Express.

Directory:

Tags:

Invisalign® braces are an effective teeth straightening method for both teens and adults. Invisalign® is a great alternative to traditional metal braces and can correct bite, teeth crowding or spacing issues. As a Platinum Invisalign® Providers, we are certified and highly experienced in helping you achieve a smile makeover with clear braces. With an Invisalign® dentist who’s open Saturday and Sunday, you can straighten your teeth with invisible braces when it’s most convenient for you.

What Is Invisalign®?

Invisalign® are transparent orthodontic devices, also known as clear aligners, that are an alternative to metal braces for adults and teens. These custom-made clear braces are practically an invisible way to adjust your teeth.

Before Invisalign®®, you had to wear metal braces to get a straight smile or just make do with how your teeth looked. Now straightening your teeth doesn’t have to involve a mouthful of metal. In fact, metal braces have become an outdated orthodontic treatment when going for a smile makeover.

The Invisalign® braces let you maintain your look without feeling out of place the way you might with clunky, unsightly metal braces. Your teeth will slowly straighten out each day and no one will even notice your teeth braces

That’s because Invisalign® aligners we use are nearly impossible to see. As you get accustomed to wearing them, you will practically forget they’re there! Although the clear trays are almost invisible, the results they provide aren’t. You will be able to observe a difference in about six weeks.

Read more: https://www.yonkersdentalspa.com/invisalign-dentist-yonkers/

Park Avenue Smiles

169 Park Ave,

Yonkers, NY 10703

(914) 965-3864

Web Address:

https://www.yonkersdentalspa.com

Our location on the map: https://g.page/yonkers-dentists-invisalign

https://plus.codes/87G8W4W5+9P Yonkers

Nearby Locations:

White Plains | Eastchester | Greenburgh | Bronxville | Rochelle | Scarsdale

10601 | 10709 | 10607 | 10708 | 10583

Working Hours:

Monday: 9:00 am - 5:00 pm

Tuesday: 9:00 am - 8:00 pm

Wednesday: 9:00 am - 8:00 pm

Thursday: 9:00 am - 5:00 pm

Friday: 9:00 am - 5:00 pm

Saturday: 8:00 am - 3:00 pm

Sunday: CLOSED

Payment: cash, check, credit cards.

Directory:

Tags:

Dental crowns are prosthetics for your teeth. Crowns — or dental caps, as they’re called — become a permanent part of your teeth and require the same care you give your other teeth. Go to a Yonkers family dentist near you, and you’ll find the dental crown cost is just as reasonable as other dentists, but you may be able to have it put in place sooner.

A dental crown is a prosthetic for your tooth. Unlike a denture, teeth caps are cemented onto your teeth, so they’re permanent. Crowns, or dental caps, cover damaged teeth completely, from the gum line up to the tip. Dental caps can be made to look just like your original teeth, matching the color and shape. You may need a dental crown to:

Restore a decayed tooth

Protect a cracked tooth

Cap a tooth after a root canal

Fix a broken tooth

Improve the appearance of your smile

Change the alignment of your mouth

Cover a dental implant

When Would I Need a Crown or Bridge?

The aim of dentistry in Yonkers has always been to preserve your natural teeth, maintaining their strength and structure and helping them to last for as long as possible, hopefully for life. Nowadays, with the help of modern preventative dental techniques, people can retain their natural teeth for longer, and if a tooth is damaged, the general expectation is that it will be restored, not removed. But, when teeth are removed, it’s essential they are replaced.

When teeth are missing, it can affect your bite and overall oral health. Nowadays more people are opting to have dental implants, and this treatment is fast becoming the gold standard. As a result, fewer people are choosing to have dental bridges which used to be the treatment of choice over removable dentures. However, sometimes conventional crowns and bridges are still the best choice in specific situations.

Read more: https://www.yonkersdentalspa.com/dental-crown/

Park Avenue Smiles

169 Park Ave,

Yonkers, NY 10703

(914) 965-3864

Web Address:

https://www.yonkersdentalspa.com

Our location on the map: https://g.page/yonkers-dentists-invisalign

https://plus.codes/87G8W4W5+9P Yonkers

Nearby Locations:

White Plains | Eastchester | Greenburgh | Bronxville | Rochelle | Scarsdale

10601 | 10709 | 10607 | 10708 | 10583

Working Hours:

Monday: 9:00 am - 5:00 pm

Tuesday: 9:00 am - 8:00 pm

Wednesday: 9:00 am - 8:00 pm

Thursday: 9:00 am - 5:00 pm

Friday: 9:00 am - 5:00 pm

Saturday: 8:00 am - 3:00 pm

Sunday: CLOSED

Payment: cash, check, credit cards.

Directory:

Tags:

At Broadway Family Dentistry, our team of expertly trained dentists combines the latest technology and highly individualized treatment plans to help you design and achieve a smile you have always dreamed of. Among the various smile-enhancing procedures that we offer are dental crowns used to restore damaged or broken teeth.

What Is a Dental Crown?

A dental crown is as much of an investment in a healthy self-image as they are to your continued dental health. Dental crowns and teeth caps are a solid way to repair your smile by making it stronger and improving its appearance. Teeth crowns also restore your teeth’s natural shape and size.

A dental crown serves as a teeth cap to cover either one of your own existing teeth or in conjunction with a dental implant. The tooth-shaped cap fits like a glove over your own tooth or the implant, covering everything above the gum line.

When Do You Need Dental Crowns?

Dental caps on teeth and crowns are often used to strengthen teeth if you have a large filling and there isn’t really enough of your own tooth left to support the filling. Your general dentist may also decide that a crown is the best way to anchor a bridge. But teeth caps and crowns are also used to:Protect teeth that are weak

Restore any that may already be broken

Cover ones that are discolored or badly shaped

Protect a dental implant

When you’re dealing with a leading family dentistry practice in Brooklyn, NY you know your smile and your oral health is the primary concern. While a crown can treat or correct the issues listed above, it’s possible that you may need additional dental work such as a root canal or filling to prepare for teeth crowns or dental caps.

Read more: https://www.broadwayfamilydentalpc.com/general-cosmetic-dentist/dental-crown-dental-caps-cost/

Broadway Family Dental

372 Stockton St,

Brooklyn, NY 11206

(718) 455–4400

Web Address: https://www.broadwayfamilydentalpc.com

Our location on the map: https://goo.gl/maps/HvSNGqfSQsQ8j9A8A

https://plus.codes/87G8M3W7+W6 Brooklyn

Nearby Locations:

Bushwick | Williamsburg | Bedford-Stuyvesant | Fort Green | Ridgewood

11221, 11237, 11201, 11203, 11206, 11207, 11211, 11213, 11213, 11216, 11233

Working Hours:

Monday — Friday: 10am-6pm

Saturday: 10am-5pm

Sunday: Closed

Payment: cash, check, credit cards.

Directory:

Tags:

Broadway Family Dentistry, located in Brooklyn, NY, is proud to offer Damon Braces. These innovative new braces are a part of the revolutionary Damon System, which combines advanced wire technology with clinically proven tie-less brackets that move the teeth faster and more comfortably, providing a truly breathtaking smile and facial results. Damon braces are a whole new way of treating both teen and adult orthodontic patients. At Broadway Family Dentistry, we pride ourselves on using the latest advances in orthodontics to reduce our patient’s discomfort and create gorgeous smiles that will last a lifetime.

What Are Damon Self Litigating Braces?

Damon Braces Brooklyn, NYOne of the latest technological advances in orthodontics is Damon fixed braces. Conventional fixed braces require an elastic to hold the wire in place. The elastic exerts a frictional force which has to be overcome before the wire is able to work and move your teeth. Self-ligating braces are able to hold the wire in place without the need for an elastic. This means the wire is able to move freely from the outset to allow your teeth to move freely and comfortably.

You can finally finish your search for “damon braces near me” by booking an appointment with a board-certified dentist Ella Dekhtyar. She offers only proven and advanced approaches that will you ensure you with a perfect smile.

Broadway Family Dental

372 Stockton St,

Brooklyn, NY 11206

(718) 455–4400

Web Address: https://www.broadwayfamilydentalpc.com

Our location on the map:

https://goo.gl/maps/HvSNGqfSQsQ8j9A8A

https://plus.codes/87G8M3W7+W6 Brooklyn

Nearby Locations:

Bushwick | Williamsburg | Bedford-Stuyvesant | Fort Green | Ridgewood

11221, 11237, 11201, 11203, 11206, 11207, 11211, 11213, 11213, 11216, 11233

Working Hours:

Monday — Friday: 10am-6pm

Saturday: 10am-5pm

Sunday: Closed

Payment: cash, check, credit cards.

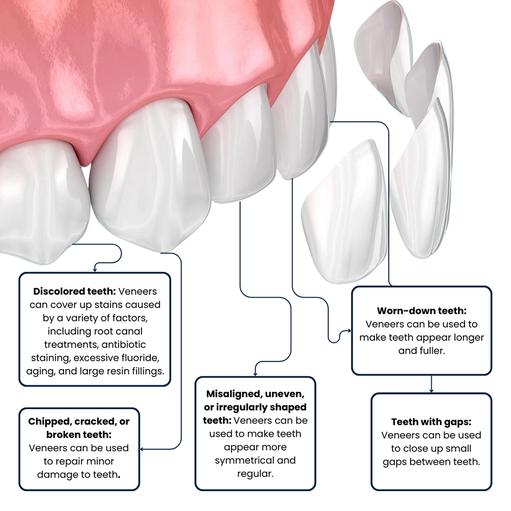

Dr. Dekhtyar, the dentist in Brooklyn, NY, uses veneers for teeth to mask cosmetic dental defects and damaged teeth. Veneers, for example, can be used to straighten crooked teeth and improve your smile. Although dental veneers are more expensive, many people have benefited from them in a variety of ways. If you’re looking for a “veneers near me“, call Broadway Family Dentistry and book an appointment right now. At Broadway Family Dentistry, we only use the highest-quality dental products available in the United States. We collaborate with the best dental laboratories in New York and only use the highest-quality dental components on the market.

What Are Dental Veneers?

Dental veneers for teeth are handcrafted coverings for individual teeth. Your general dentist at Broadway Family Dental uses these strong coverings to correct or cover many dental cosmetic problems. Veneers for teeth are wafer-thin shells that cover the front of the tooth to enhance its appearance.

Aside from aesthetic purposes, veneers for teeth have a variety of applications. Dental veneers for crooked teeth, for example, have a cosmetic and a practical effect. They don’t discolor with time and are resistant to chipping and fracture, whether they’re made of resin or porcelain.

Read more: https://www.broadwayfamilydentalpc.com/general-cosmetic-dentist/dental-veneers-veneer-teeth-cost/

Broadway Family Dental

372 Stockton St,

Brooklyn, NY 11206

(718) 455–4400

Web Address: https://www.broadwayfamilydentalpc.com

Our location on the map: https://goo.gl/maps/HvSNGqfSQsQ8j9A8A

https://plus.codes/87G8M3W7+W6 Brooklyn

Nearby Locations:

Bushwick | Williamsburg | Bedford-Stuyvesant | Fort Green | Ridgewood

11221, 11237, 11201, 11203, 11206, 11207, 11211, 11213, 11213, 11216, 11233

Working Hours:

Monday — Friday: 10am-6pm

Saturday: 10am-5pm

Sunday: Closed

Payment: cash, check, credit cards.